We analyze and enrich data on millions of non-standard workers to unearth workforce and economic trends.

We use those insights to create solutions to help our partners better understand, serve, and employ those workers. Those partners include employers, state benefit agencies, lenders, and workforce organizations.

Public Benefit Agencies

We improve efficiency of state and federal program eligibility programs. We also reduce fraud and promote program integrity. And finally, we improve the claimant / participant / beneficiary / obligor experience by helping to deliver fast and accurate public benefits. State caseworkers are burdened with a substantial backlog of cases to clear to get the public their time-critical benefits. Every day matters. Historical processes to verify 1099/gig income are time consuming and error prone. We help states leverage technology to do more with less, thus allow the caseworker to better apply their skills to help the programs' participants.

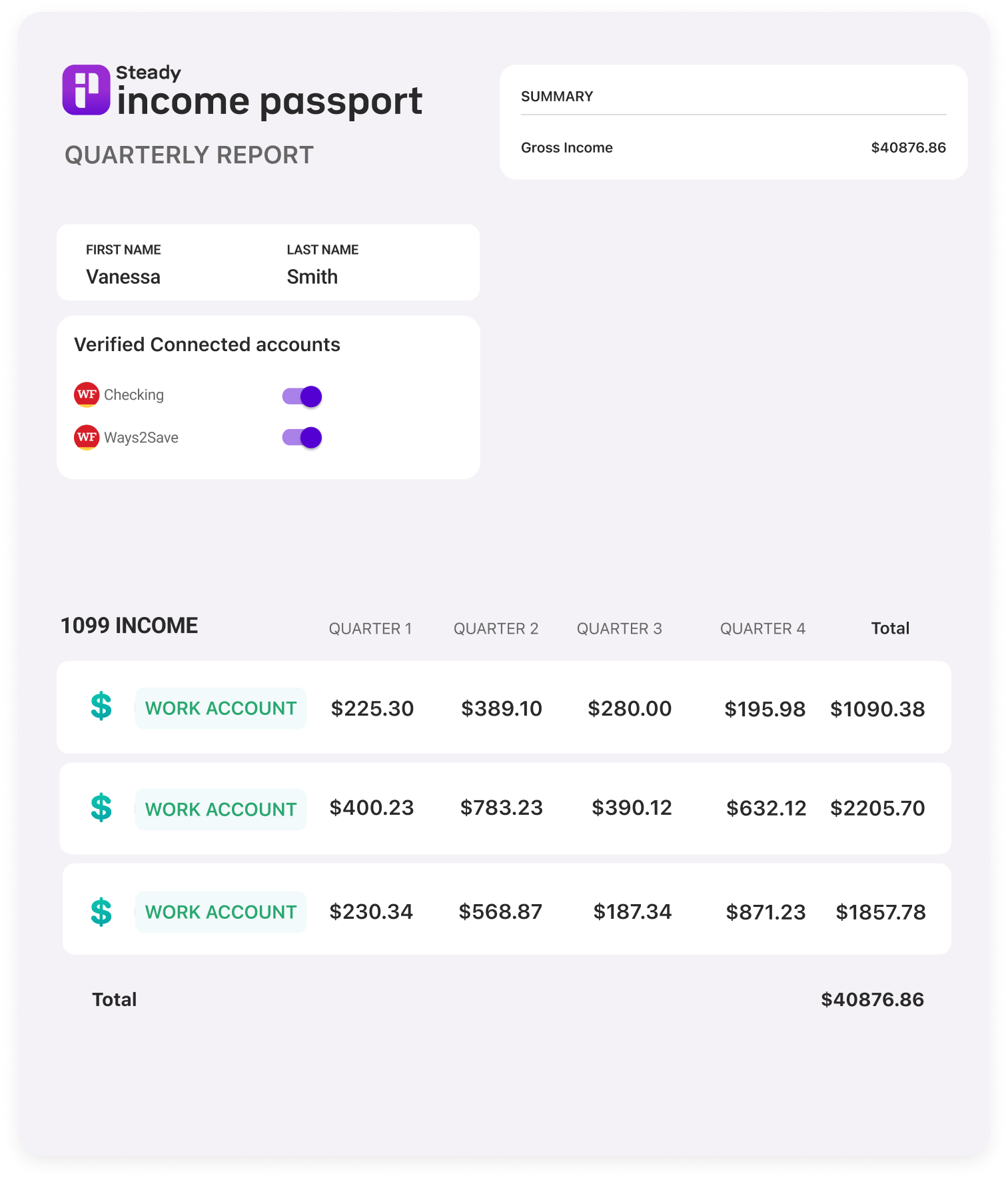

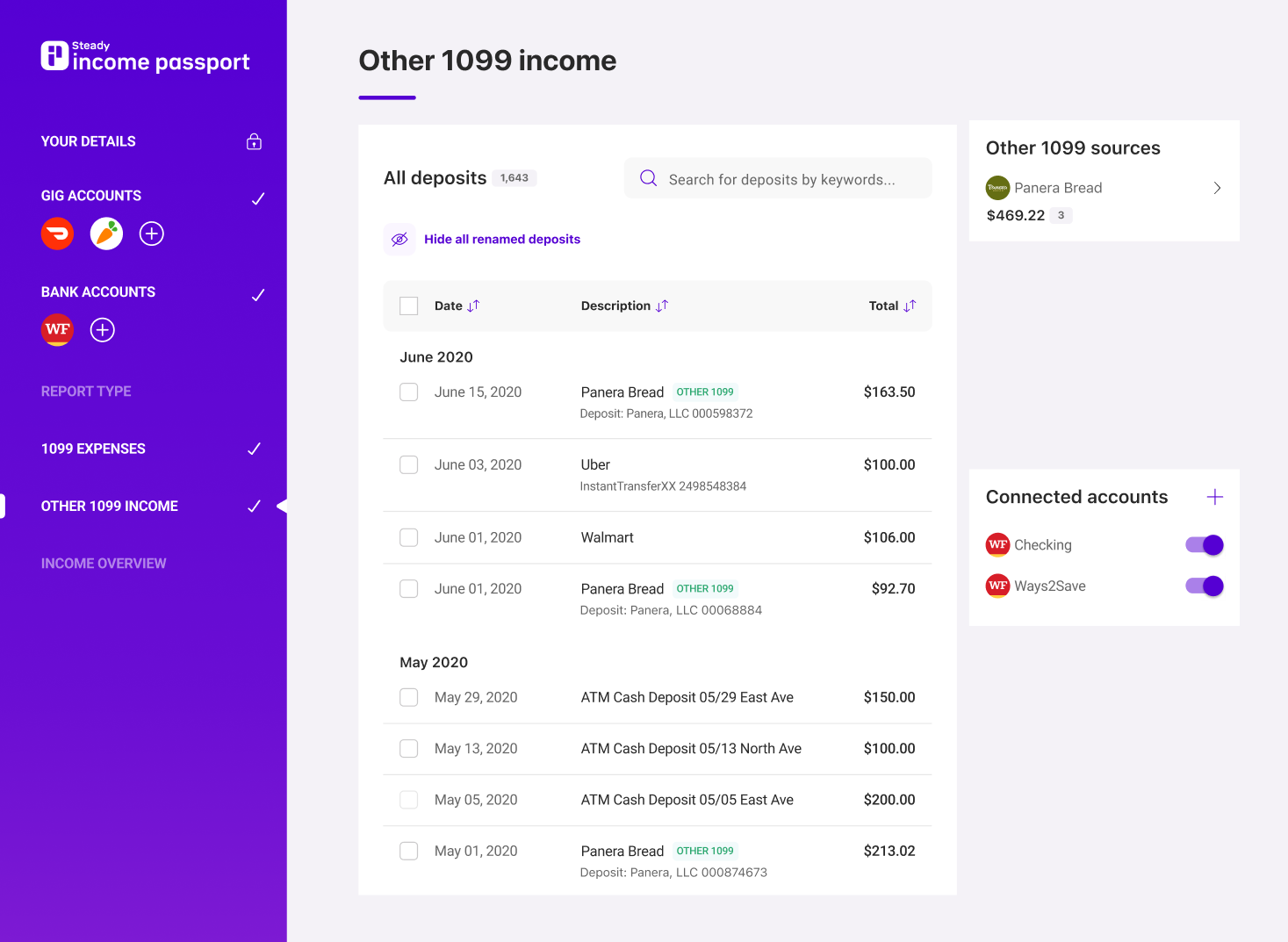

Lenders

Expand addressable market and promote more inclusive lending practices. Improve efficiency and accuracy of verifying income for 1099 and gig workers. Increase approval rates. Boost image by serving historically underserved and discriminated against borrowers. Without a W-2 or paystub, non-standard workers are required to cobble together tax returns (latent), bank statements, receipts and more to prove their income. Sadly, all too many are denied credit which leads to a reliance on predatory loans. No paystub, no problem: Income Passport

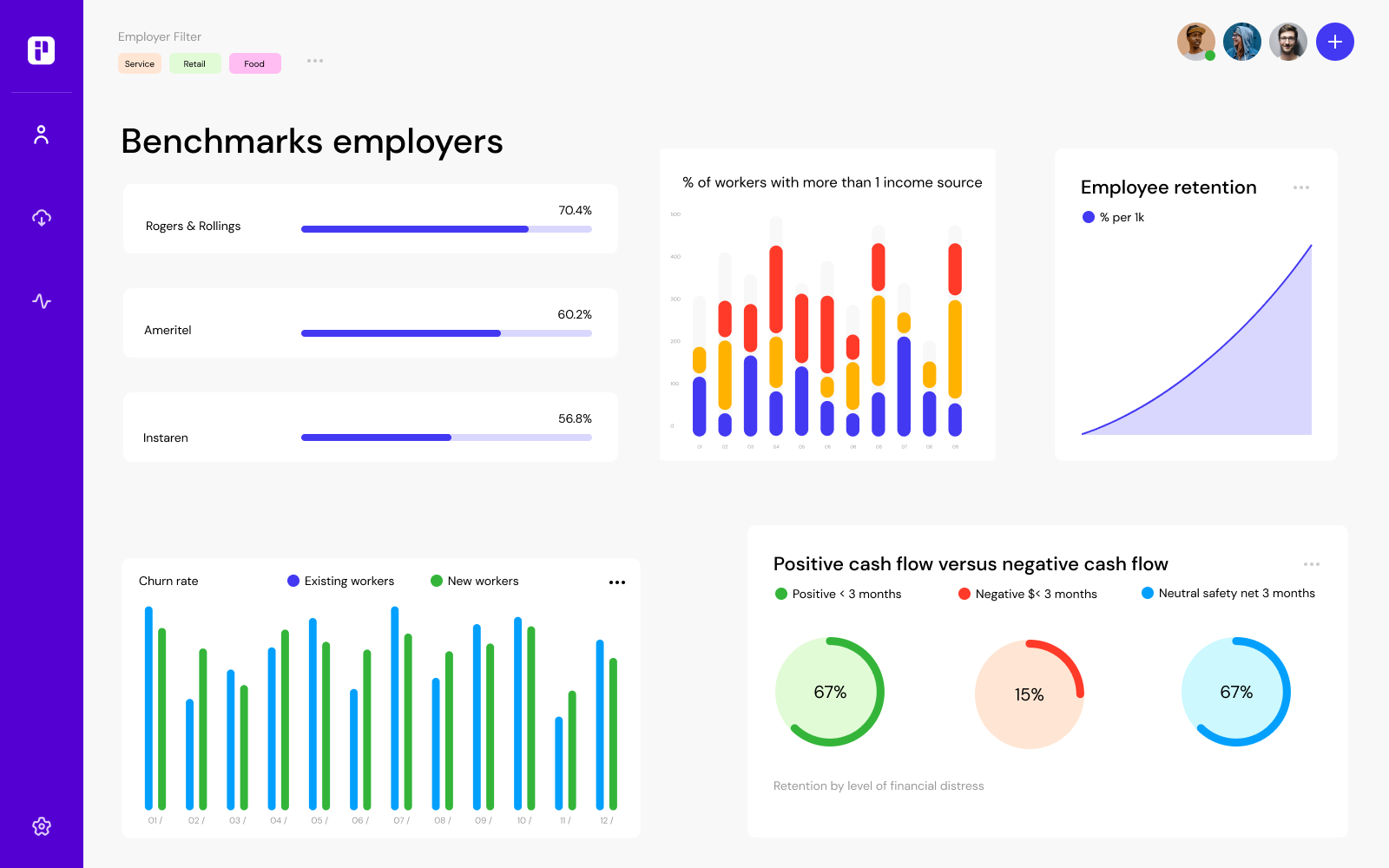

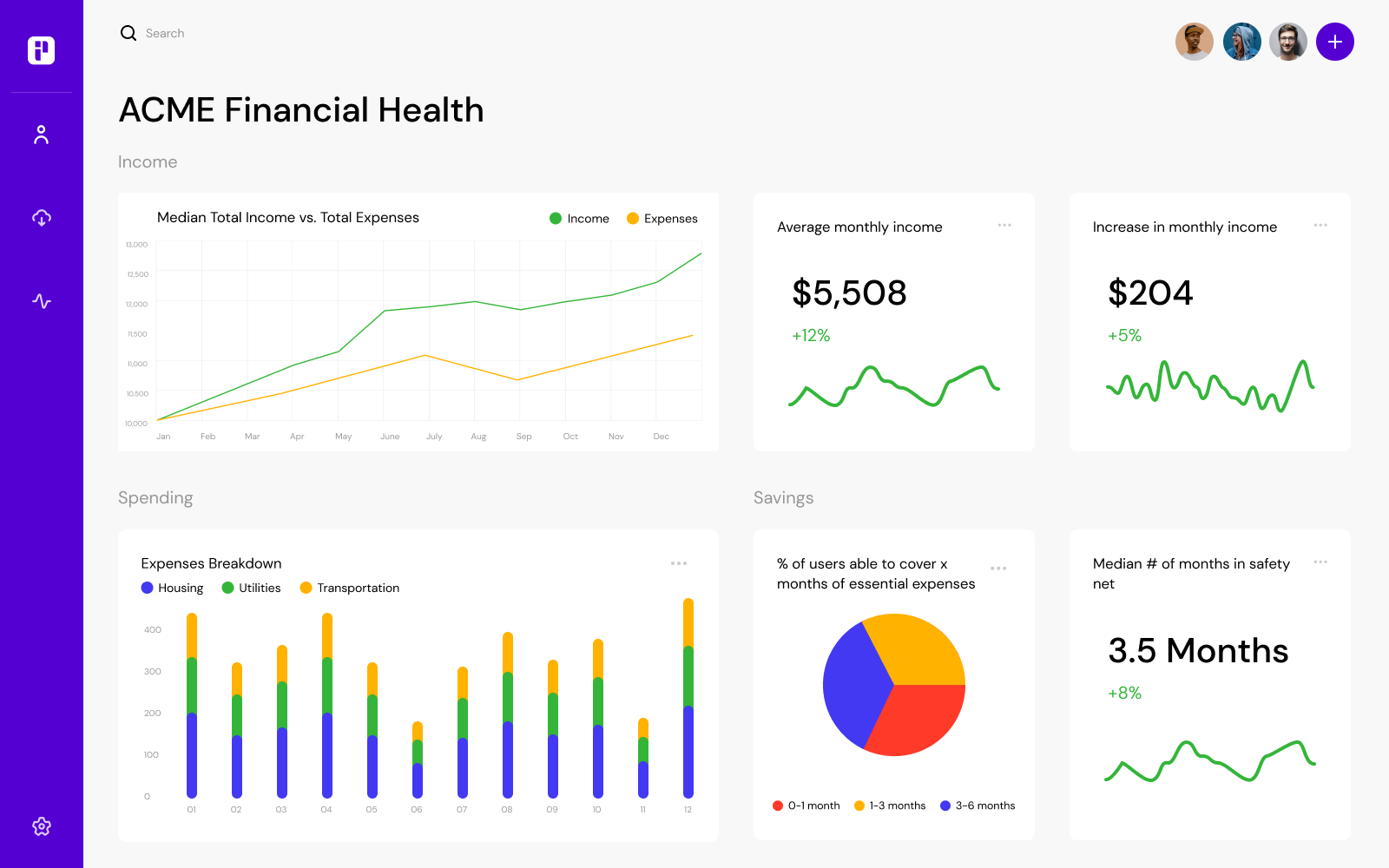

Employers

Understand financial wellness and earning/spending behavior of workforce. Reduce costly turnover and attrition. Improve employee satisfaction and loyalty.

Workforce Organizations

Better coach/guide members to financial wellness. Improve earnings potential. Understanding financial health over time.